Disclosure:

This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Renter payment problems are the number one concern for landlords, according to TransUnion SmartMove’s 2014 user survey. So it’s no surprise that a credit score would be one of the first things a landlord would be interested in when screening a potential tenant. The same survey shows that most landlords feel confident in their ability to understand a credit report, but what do they do with the information they find on there? How should a low credit score affect the decision making process when screening tenants?

Fox Business reports that 30% of Americans have subprime credit. Considering the fact that a lot of people have a bad credit score, where do you draw the line? A low credit score doesn’t have to automatically disqualify a potential renter, but you should take certain steps when considering an applicant with less than stellar credit.

Read on to find out more about credit score ranges, how SmartMove’s ResidentScore can help you more accurately predict bad rental outcomes, and what other factors you should consider.

Credit Score Ranges

According to TransUnion, there is not a definitive “good” credit score and many factors determine credit worthiness. In fact, your tenants have more than one score. There are different credit scoring models and the three credit bureaus may not use the same equation to determine a score. Further, each lender may use a different scale or look at different factors when determining whether someone qualifies for a loan (as well as their interest rate).

While the lower end of the range assumes a higher level of risk, credit reporting bureaus do not define scores as “good” or “bad.” While certain ranges can be used as a rule of thumb, it’s up to landlords and lenders to decide what level of risk is acceptable to them.

Additionally, TransUnion explains that scoring models may be tweaked periodically to keep up with current economic trends. For example, VantageScore (the creation of three major reporting bureaus, including TransUnion) has used three separation models since its inception in 2006.

VantageScore 3.0 is the most current model, and it covers a range from 300 to 850.

When it comes to renting, it’s hard to say exactly what score should cause a landlord to decline a tenant. Generally, people with lower credit scores may have troublesome payment behavior that could put them at a higher risk for an eviction.

It’s important to note that there are industry specific models of scoring. In fact, there are hundreds of credit scores on the market and each industry looks at certain predictors to calculate risk. Looking at a score that uses an auto insurance risk model to predict the likelihood of a claim doesn’t give you clear insight into a renter’s likelihood to pay rent on time.

ResidentScore

SmartMove ResidentScore is designed specifically for rental screening. It’s built to predict the outcome of a lease, such as the risk of an eviction, the likelihood of a tenant having more than three late rent payments, and insufficient funds (i.e. paying less than the total amount owed).

Ryan Nichols, Senior Analyst at TransUnion, explains, “By using a model specifically intended to predict rental industry outcomes, you will be more likely to identify good tenants than using a typical credit score.”

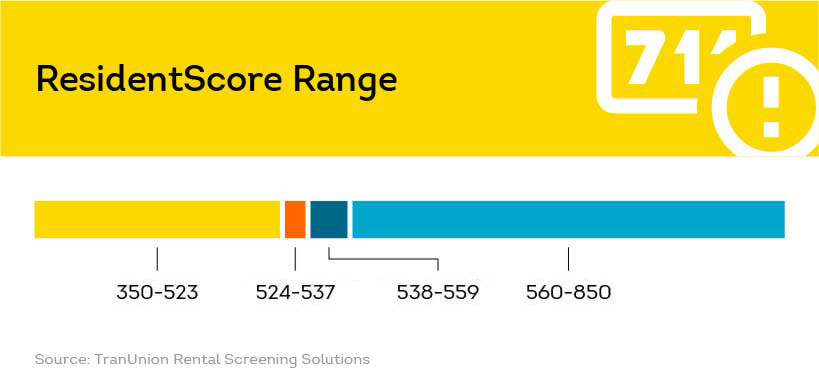

Using a scoring range that is common in typical credit scores, prospective tenants are awarded a score from 350-850, with 850 being the best possible score.

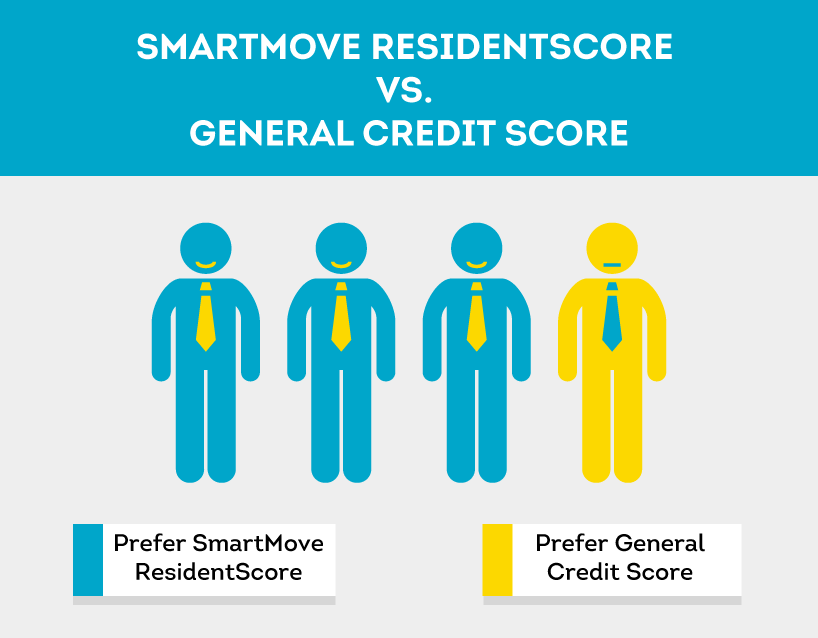

Potential renters in the bottom score range may be at a higher risk for eviction. According to TransUnion’s research, ResidentScore predicts evictions 15% more often in comparison to a typical credit score in the bottom 20% score range where risk is greatest. This is likely a large part of the reason that three out of four landlords prefer SmartMove’s ResidentScore to a general credit score when screening tenants.

However, while a score below 523 is considered to be low, there are other things to consider before automatically declining a prospective tenant in this range. Most independent landlords look at the whole story. A 2016 SmartMove user survey of independent landlords showed that the majority look at more than just the score.

It’s important to dig into the credit report itself. Some items may be of less concern, and you may find that a prospective tenant with a low credit score is still a good match for you. For example, if the score is low because the applicant had a bankruptcy that has been discharged, they may now be in a better position to manage their finances.

Screening Tenants

If a tenant has a low ResidentScore, dig deeper. Order a complete credit report for landlords for the full story on the reason for the score. Certain items may be more of a concern than others. For example, overdue credit card payments could indicate a mishandling of finances while medical debt could simply be an unfortunate situation due to circumstances outside of their control.

Remember to consider other aspects of a tenant’s background including criminal and eviction history. In cases where you are on the fence about their score--say they fall into the conditional range of ResidentScore--consider other factors before making a decision.

When screening a tenant, other factors worth considering would be:

- Income

- History of late rent payments

- Previous relevant convictions

- Employment history

Rescreening Tenants

Should you periodically rescreen tenants for poor credit? TransUnion’s 2017 Rescreening Analysis found that rescreening current tenants isn’t always necessary since renter credit profiles don’t change much over the course of a 12 month lease. ResidentScore is designed to provide a more accurate assessment of risk for your future rental property income than a typical credit score. This means that you are more likely to get a reliable tenant with longer tenure when you use it.

Rescreening may be needed if the tenant has not been paying rent on time. Then you might rescreen to find out whether they have accrued more debt or have lost their job. Before renewing a lease, there are other valid reasons for rescreening, such as searching for recent criminal records. If you’ve completed a thorough SmartMove screening the first time, rescreening just to look at credit score may not be necessary.

Conclusion

Simply considering whether or not a potential tenant has a bad credit score doesn’t give you the full picture, and you may end up turning away a reliable tenant. SmartMove’s ResidentScore, along with a full screening package including a full-credit report, criminal report, eviction check, and Income Insights report can more accurately help you predict risk and bad rental outcomes. Armed with this information, you’ll be able to make more knowledgeable decisions about your applicants and have greater assurance that your future tenant will pay their rent on time.

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.