Disclosure:

Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

There are several things to consider when evaluating whether a prospective tenant is a good fit for your rental property. These include:

- Credit history

- Income

- Rental history

- Relevant criminal convictions

Many landlords know that checking their prospective tenant’s credit history is one of the best ways to predict whether they’ll pay rent on time. A good credit score indicates that an applicant has a track record of paying their bills on time and can be predictive of the tenant’s likelihood to pay rent.

However, there are other elements of the prospective tenant’s background that can be equally as revealing as a credit check. Certain warning signs could indicate the tenant will put your rental income at risk. An in-depth tenant screening that looks at more than credit history will provide additional insight into an applicant’s background and reveal more about their potential reliability as a tenant.

Even if an applicant has good credit history, there are several reasons why a landlord might reject them. Here are four of these reasons.

1. Poor Rental History

Evicting a tenant can be a lengthy, costly process no landlord wants to go through. TransUnion SmartMove data based on customer experiences found that total eviction-related expenses for property managers average $3,500 and can reach as high as $10,000 in some locations. TransUnion research also shows that prior evictions are highly predictive of future evictions.

It’s no surprise that landlords who see an applicant with an eviction record may be reluctant to rent to them. Ordering a national eviction report can give an in-depth look at information including:

- Tenant judgment for possession and money

- Unlawful detainers

- Tenant judgments for rent

- Failure to pay rent

- Writs and warrants of eviction

In addition to ordering an eviction report landlords should contact the applicant’s landlord references. Previous landlords can offer valuable information if you ask the right questions: Were there any damages? Were there pest issues? How many times did the tenant pay late? It’s a good idea to contact the previous landlord for information even if it is only anecdotal.

2. Criminal Background

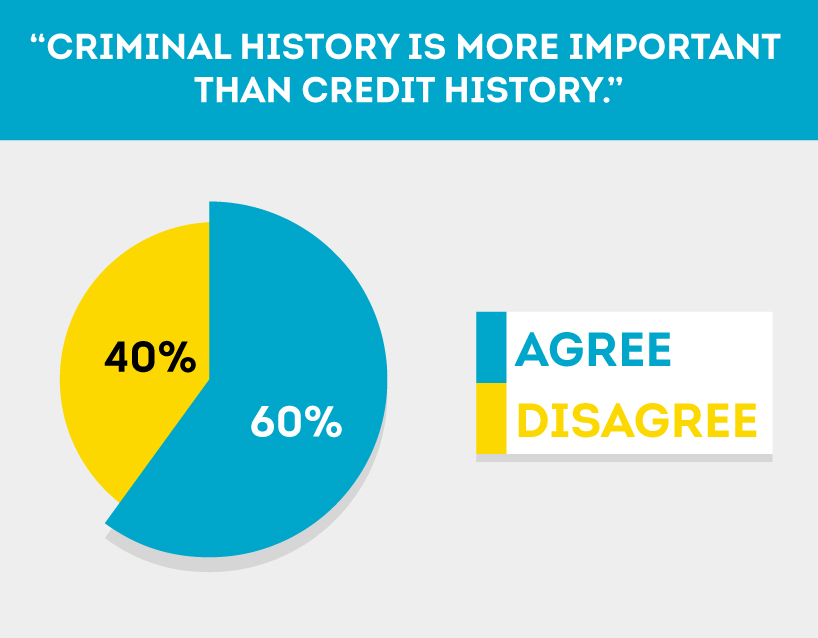

In a 2016 SmartMove user survey, 60% of respondents strongly and somewhat agreed that criminal history is more important than credit history. Landlords want peace of mind that their tenant does not have a history of placing property or other persons at risk. After all, you don’t want to put other residents (or your property) at risk by not checking your applicant’s criminal history.

An in-depth criminal report can give a landlord important insights into an applicant’s criminal background. HUD recently released new guidance regarding background checks that landlords can use to help steer their decision-making when reviewing criminal records. Not all criminal records are deal breakers, but an applicant with a lengthy record that appears to be a risk to your rental property and the neighborhood could be a bad fit with your standards.

Landlords who perform background checks through SmartMove receive a criminal report pulled from state and national databases containing over 200 million records. Additionally, TransUnion can find more records that potentially match an applicant by supplementing the applicant’s own information with data from TransUnion’s databases, leading to more accurate results and fewer false positive matches.

3. Insufficient Income

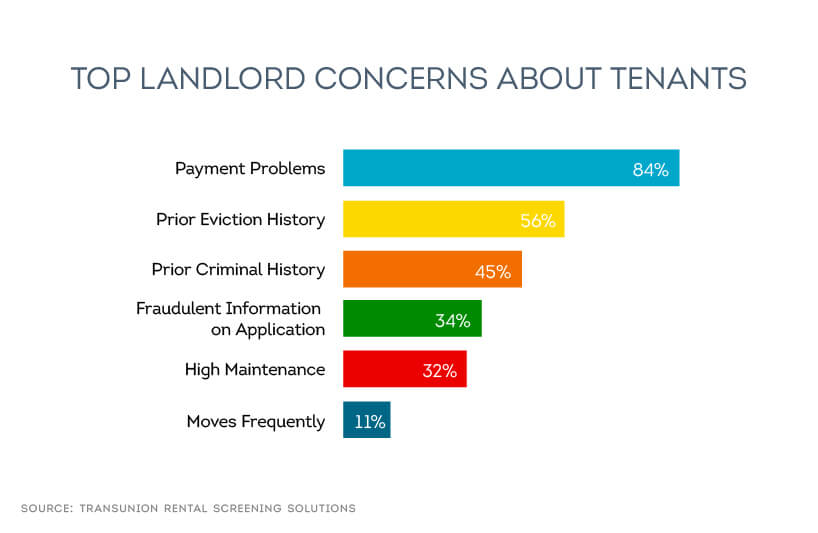

Non-payment is one of landlords’ top concerns about new tenants. Many landlords depend on the income from their rental property in order to make mortgage payments they might have on the property. A late rent payment could mean the landlord’s mortgage payment is late. In some cases, tenants might stop paying rent altogether, requiring the landlord to file for eviction.

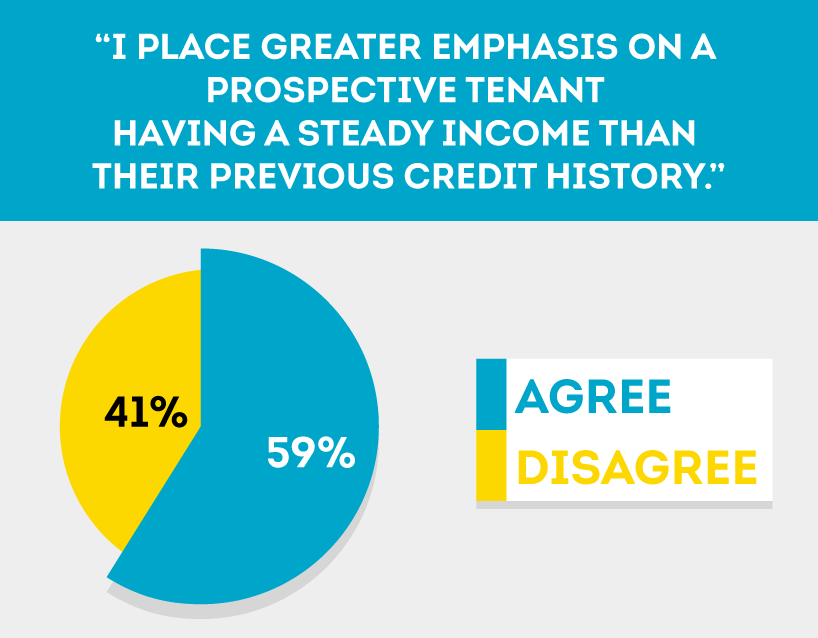

Considering the stress and anxiety late payments can cause for landlords, it’s not surprising that they want their tenants to have steady income and employment. In fact 59% of respondents to a 2016 SmartMove survey strongly and somewhat agreed they place greater emphasis on a prospective tenant having a steady income rather than previous credit history.* A steady income and employment history can give landlords more confidence that their applicant has the means to pay rent on time.

The amount of income is also important. Requiring a monthly income that is three times the rent is the industry standard and is a good indicator that the tenant can afford the rent on their salary. It’s important to check current pay stubs and have an actual conversation with their employer (on a company line). Things may have recently changed in their financial situation that would affect their ability to pay rent. For instance, someone who recently lost their job may not be bringing in the income they used to, they may not be able to continue paying all their bills on time, even if their credit report shows a financially responsible background.

Even if an applicant has a good credit history, a spotty employment record and too little income may be a warning sign that they won’t be able to make their rent payments.

4. Other Important Criteria

Sometimes an applicant would be a good tenant for another landlord, but they don’t meet the lease criteria in this particular rental. For example, they have a pet and are trying to rent from a landlord with a no-pet policy. Perhaps they want to move in too many occupants for a certain unit. Last but definitely not least, reference checks can strongly influence a landlord’s decision. Poor landlord, employment, or personal references can quickly turn the screening process sour.

Conclusion:

It’s important to check an applicant’s credit report before deciding to rent to them. However, a more complete tenant screening should include more than a review of their credit report. By implementing a consistent tenant screening process that includes credit reports, criminal background , and eviction checks, you have a much more complete picture of their background. This way, you’ll be able to make a better informed decision about the applicant’s reliability and have a greater chance of finding reliable tenants. With SmartMove’s quick and reliable tenant screening service, you’ll be able to make faster and more informed decisions.

*2016 SmartMove user survey

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.