Summary:

You walk by it every day. It’s empty except for a bed, a nightstand, and a stack of old clothes that need to get donated when you get around to it. Yes, the guest room is a nice thing to have, but acts as a quiet vampire on your mortgage payment. You’re shelling out money each month for square footage that only gets used three nights a year when Nana visits.

Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

Disclaimer: Remember that this material is intended to provide you with helpful information and is not to be relied upon to make decisions, nor is this material intended to be or construed as legal advice. You are encouraged to consult your legal counsel for advice on your specific business operations and responsibilities under applicable law. Trademarks used in this material are the property of their respective owners and no affiliation or endorsement is implied.

So, how do you get your guest room to make you some extra income First, let’s look at why more and more Americans are asking the same question.

Homeownership costs are only going up in the US. In April 2019, 21% of U.S. homeowners got a second job or found an additional source of income to help them afford their mortgage payments. While starting a gig at your local Starbucks might seem like the quickest option for gaining additional dollars, there could be another way to do this from the comfort of your own home.

If you own a home with additional rooms that are not being used, then you might consider renting out that extra space. This could help you:

- Supplement monthly income

- Pay off your mortgage

- Learn the skills for running a rental business

But, before you go and find a tenant who’s up for sharing the fridge, make sure you run a comprehensive background check from a trusted provider solution like SmartMove®. And as always, you should check laws applicable to you and consider consulting legal counsel to help you determine your abilities and responsibilities; this material is not to be construed as legal advice nor as a comprehensive set of information.

Powered by TransUnion data, SmartMove delivers crucial tenant data including credit reports, criminal background and eviction history. Screen for great tenants before a lease gets signed and get important insights in just minutes.

This article covers the following topics:

The Roommate Age

According to research from Pew Research Center, shared living has become more prevalent in the decade following the Great Recession. A shared household is defined as a household with at least one “extra adult” who is not:

- The household head

- The spouse or unmarried partner of the household head

- An 18 to 24 year-old student

Their study found, in part, that in 2017, almost 32% of the adult population lived in a shared household. Compare that to pre-Recession numbers; in 2004, just 27% of adults shared a household.

It’s clear that if you’re looking to take on a tenant to help cover your mortgage payments or earn additional income, then there are plenty of renters searching for a space to lease.

However, renting out a room in your house comes with its own set of challenges, namely, finding tenants who will pay rent on time. According to a SmartMove® survey, nonpayment of rent is a landlord’s top concern, and it’s not hard to understand why. If you’re using the rent to cover your mortgage payments, what will you do if a tenant doesn’t follow through on their rent obligations

If you do decide to rent out your room, avoiding eviction is a top priority. Evicting a tenant can be a time-consuming and costly process. According to a TransUnion survey, evicting a tenant may take up to three to four weeks and costs an average of $3,500.

When you take on a room tenant (or roommate), you also take on a significant amount of responsibility. Even if you’re not renting out an entire property (and live there), you are still considered a landlord, which means you are subject to the rules and regulations governing landlords. Additionally, you’re choosing to share your living space, which could become frustrating the longer you live together.

There’s plenty to keep in mind when considering renting out a room, but if you’re ready to find a live-in tenant and take advantage of monthly rental income, then remember these essential tips to help set yourself up for success.

Tips on How to Rent Out a Room in Your House

1. Make Sure the Room is Tenant-ready

As a landlord, you generally have a responsibility to create a habitable living space before taking on a tenant. You are subject to what is often referred to as the “Implied Warranty of Habitability.”

This is a warranty implied by law in all residential leases basically stating that the premises are fit and habitable for human habitation at the start of tenancy. In addition, it typically requires that the property will remain fit and habitable throughout the tenant’s lease or rental agreement.

Before taking on a live-in tenant, you need to determine whether you have the means to fix up the space, both now and later on through continued maintenance. It’s important to consider your financial situation along with your own repair capabilities.

For example, if your tenant’s toilet leaks, are you able to roll up your sleeves and fix the issue Or will you need to hire outside help If it’s the latter, it’s important that you have the money required to cover such repair costs.

Before committing to becoming a landlord in your own home, be sure you understand the level of responsibility and financial burden it can entail.

2. Consider the Criteria of Your Ideal Tenant

If you rent out a room in your home, then you’ll become both landlord and roommate – are you comfortable sharing your personal space with someone else You must reflect on what you want from a roommate and a tenant, before the moving boxes start showing up.

Deciding on renter criteria early on provides several benefits:

- It makes it easier to write a rental listing

- It can help you tailor your screening questions when you start accepting applications

- It can help provide clarity into what you’re looking for

Here are a few examples of renter criteria you might consider:

- Enough income to afford rent

- Proven track-record of paying on time

- No criminal record

- No past evictions

- Doesn’t have pets

- Is a non-smoker

Pro-tip:

If you will be allowing your tenant to have a pet, and you have a pet yourself, consider how your furry-friend reacts to other animals in its space. If your pet has a tendency to be territorial, then you should probably refrain from inviting another pet into your home. Overall, be sure you understand the pros and cons of allowing pets in your rental space.

3. Create a Transparent Rental Listing

Once you’ve created your ideal tenant profile, create an effective rental ad to help attract prospective tenants. Within your listing, it’s important to highlight specifically what you’re offering and your property’s amenities, both shared and private. For example, if the only private space you are able to offer is a single bedroom within suite, then be sure to specifically note that as well as the specific living areas that will be shared.

In addition, it may be worthwhile to point out local attractions or conveniences that may help attract your ideal tenant. Think back to your tenant criteria – what kind of tenant are you looking to rent to

For example, if you’re hoping to rent out a room to a working professional, you might highlight local transit access for commuting. Or, perhaps you’d like to capitalize on seasonal college student tenants; in this case, your listing might highlight proximity to campus, local bars and recreational areas.

Your rental listing should be used to set clear expectations and explain basic requirements to potential renters. Notifying applicants of your requirements upfront can help you deter those who may be unqualified.

Beyond highlighting amenities, you should also explain rental application requirements such as:

- Completed rental application

- Referrals of previous landlords

- Current employer and contact information

- Authorization of credit and background check

Renting out a room in a primary residence comes with additional considerations. As you’ll be living with this tenant, you need to set behavioral expectations, as well. Be clear about what you’re looking for in a roommate, including your requirements surrounding:

- Quiet hours policies

- Use of communal space

- Frequency and amount of guests allowed in the space

- Access to shared amenities (Ex: garage, patio space, kitchen, etc.)

By setting these expectations upfront, you should be able to narrow down your pool of applicants more easily and increase your chances of finding a high-quality tenant that hits all your marks.

4. Set the Right Rent Price

No one wants to overpay for rent, so you’ll need to research on how much to charge when renting out a room in your home. Setting the right price can help secure your rental income, as pricing correctly could mean the difference between filling the room and dealing with a vacancy.

Before you even create a rental listing, learn how to set the right rental rate. Choosing the appropriate rent cost is important for several reasons. If you price too high, you may find it hard to rent out the bedroom. On the opposite end of the spectrum, if you price your room too low, then you may lose out on profit or attract no so great applicants.

Consider the average income of those who live in your rental market area. Your rental rate should target prospective tenants with similar earnings so you can fill your empty room faster and get paid sooner.

You might consider using Rentometer.com to help determine average prices, check out local forums, ask other landlords, or search “rooms for rent” on Craigslist, Roommates.com, and other similar sites to see what homeowners are charging in your area.

5. Become Familiar with Landlord Laws

Becoming a landlord means taking on a great deal of responsibility—and opening yourself up to the risk of tenant litigation.

Pay close attention to federal HUD guidelines governing tenants when choosing an applicant. It’s generally illegal to refuse to rent or sell a home to anyone based on:

- Race

- Sex

- Mental or physical disability

- Religion

- Familial status

- National origin or ethnic background

There are also local laws to keep in mind. Landlord-tenant law can vary from one city to the next, so you must read up on how to qualify and deny rental applicants the right way.

To help protect yourself from future tenant issues, consider seeking legal counsel from a real estate lawyer in your area to ensure you understand and follow local, state, and federal regulations.

6. Write an Airtight Lease

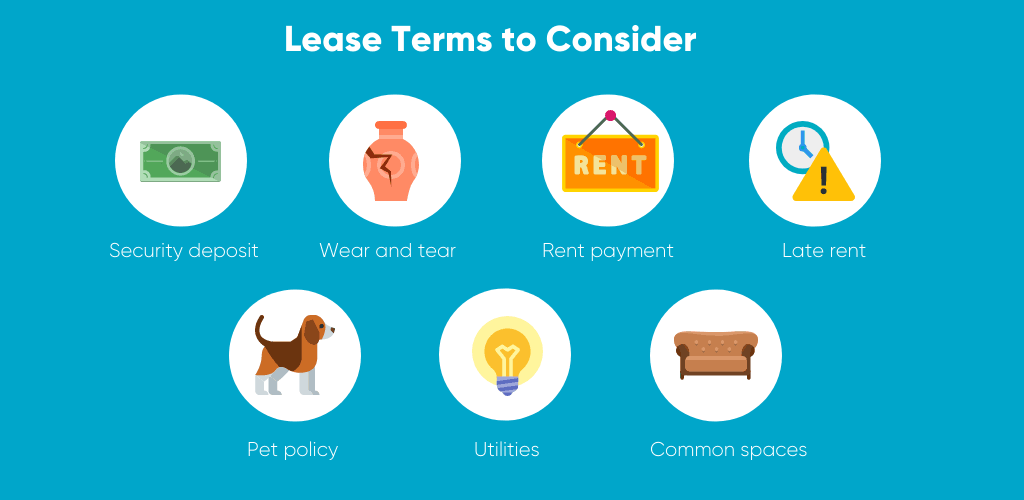

An airtight lease agreement is crucial, as it could serve as your protection if a landlord-tenant dispute ever arises. As you draft your lease or rental agreement, there’s plenty to keep in mind. Here are some of the terms you should consider in a rental agreement:

- Security deposits: A security deposit is used as a reimbursement in the event of damages or for other losses in revenue, such as rent non-payment. The amount you can charge for a security deposit is determined by state law, so do your research before settling on a price.

- Wear and tear: “Normal wear and tear” refers to the expected depreciation that naturally results from a tenant living in a property, such as faded carpet, peeling wallpaper, or worn-out floors. However, it’s important to distinguish between expected deterioration and damages due to tenant abuse or neglect, such as broken windows, carpet burns, or chipped flooring.

- Rent payment: You should designate how and when rent must be paid, and whether it’s paid by check, cash, or from an online rental collection.

- Late rent: Your lease should indicate what happens if your tenant pays rent late, including late fees and eviction processes if applicable. As a landlord, you are incentivized to collect rent in full on the day it is due. If you rely on rental income for your own bills, setting a precedent that late payments are acceptable can be a slippery slope. The standard late rent fee is 5%, but consider local laws when creating your lease.

- Pet policy: Will you allow your new tenant to bring pets into your living space Be upfront about your pet policy, and delineate pet deposits and fees if you do decide to allow animals.

- Utilities: As you will be sharing communal areas and amenities with your tenant, you need to determine how to split the costs of utilities. Make sure your lease indicates how and when utilities are paid.

- Access to common living spaces: What is the tenant’s access to common areas in the property This may include the kitchen, laundry room, living room, and other areas of the property. You must decide if you plan to create a separate entrance and consider how your tenant will affect your usage of the space.

Pro-tip:

Consider speaking with an attorney when setting up your first lease agreement to ensure everything is done by the book.

7. Interview Your Applicants

Once you’ve published your rental listing and begin collecting applications, set up initial interviews, either by phone or in-person. Your first conversation with a prospective tenant may help you quickly dismiss unqualified applicants. Ultimately, this step could help you save time when it comes to giving rental showings.

8. Review Rental Applications

Require a rental application from every prospective tenant. Once you’ve collected applications, review them to determine if the applicant meets your renter criteria. Ask yourself these questions as you review:

- Do they make enough money to afford the rent

- Do they have healthy credit history

- Did they indicate a relevant criminal background

- Does their rental application list any evictions

Note: this information as a preliminary step. If their answers and application information complement your renter criteria, you can confirm what they’ve reported later on using a full background check from somewhere like SmartMove.

9. Complete a Full Tenant Screening

Once you’ve gone through applications and conducted phone interviews, it’s time to select your top pick and conduct a full tenant screening.

According to a 2016 SmartMove survey, more than 95% of landlords said they believe tenant screening is beneficial and helps them get a higher-quality tenant into their rental unit*.

It’s crucial that you don’t just go with your gut, as placing the wrong tenant in your home could have longstanding consequences. Ideally, you want to rent to someone who has a healthy financial history is free of a criminal and eviction history.

Conduct a landlord and employer reference check

After reviewing their rental application, consider calling your prospective tenant’s two previous landlords to help confirm that the listed rental addresses are correct. Additionally, you can confirm whether or not the tenant paid rent on time and how they treated the property. This information may help you better predict how the tenant might behave while living in your home.

You should also complete an employer reference check to ensure your tenant is employed; this will help you verify your tenant has enough income to cover rent each month.

Run a full background check

After completing reference checks, formally screen your prospective renters with an online screening service like TransUnion SmartMove®. By using an FCRA compliant screening service, you can get a more complete picture of your tenant and ensure you’re placing the right person in your open room. SmartMove landlords will receive the following reports.

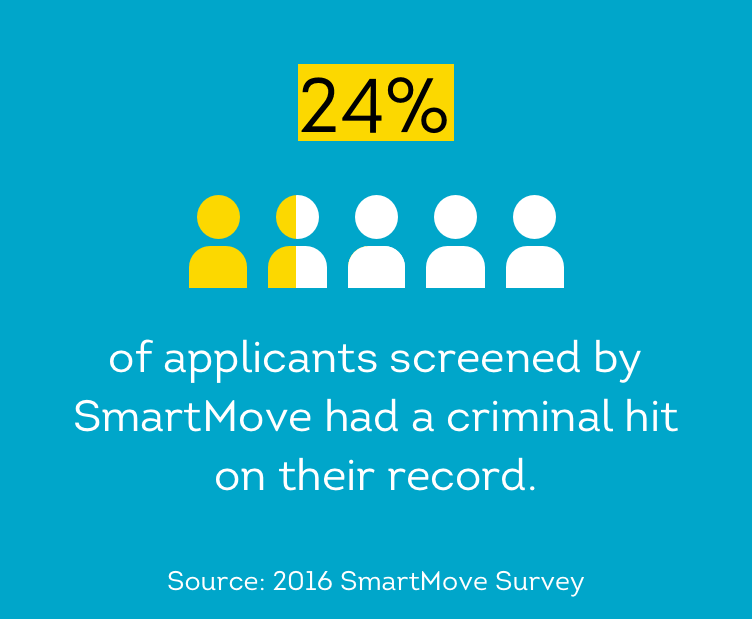

- Criminal history: It’s important to ensure that you and your neighbors are safe, which is why it’s crucial to run a criminal history check on every new tenant. Up to 24% of applicants screened by SmartMove had a criminal hit on their record. Ultimately, a criminal report could help predict future issues with your tenant.

- Eviction history:According to a 2014 SmartMove user survey, the top two concerns of landlords are payment problems and eviction history.Past evictions may be an indicator of a troublesome tenant and landlords are highly incentivized to avoid eviction at all costs. SmartMove data shows that 8% of people screened by SmartMove have an eviction record. Considering that eviction-related expenses can cost a landlord upwards of $3,500, it’s worth it to vet an applicant’s eviction history upfront.

- Credit check: If you’re renting out a room in your house, then you may be relying on that rental income to handle your mortgage payments every month. A full credit check gives insight into your applicant’s financial history. Importantly, it provides information that can help you to understand if they will make monthly rent payments on time. With SmartMove, landlords also receive a ResidentScore® for your applicant. This is our proprietary credit scoring model that is proven to identify eviction risk 15% better than generic credit scores.

Pro-tip: Prior to reviewing a credit report, you should consider calculating a rent-to-income ratio, which measures the monthly or annual gross income a tenant must earn to be able to cover housing costs. While the industry standard is 3x the monthly rent, it’s important to evaluate market conditions and fair market rent. For instance, 3 times monthly income to rent in a very expensive market (New York City, San Francisco) might not be a correct benchmark, so consider the current conditions in your area. Once you know how much your ideal tenant should make each month, you can better examine their credit and Income Insights report.

If you haven’t noticed any tenant screening warning signs after running a thorough background check, then you can feel more confident that you’re choosing a great tenant for your spare room.

10. Remember that Rental Income is Taxable

Our final tip: Becoming a landlord means taking on an array of new responsibilities, including paying your dues Uncle Sam.

Taxes will take a significant chunk out of your rental income. Rental income has been defined by the IRS as “any payment you receive for the use or occupation of property.” But remember to consult your tax and legal advisors. Such payments may include:

- Normal rent payments

- Advance rent payments

- Security deposits

- Tenant payment for canceling a lease

- Tenant-paid expenses

- Property or services received as rent

You generally must report rental income on Form 1040, but it’s important to keep detailed records throughout the year, including payment receipts, expenses used to keep the property in good condition, and other important pieces of documentation.

Learn more about ways you can save when tax season comes around with this round-up landlord tax post.

Final Notes

Renting a room in your house can be a lucrative move and help you handle your monthly mortgage payments. However, you should consider all the pros and cons of becoming a live-in landlord before renting out a room in your home.

Remember, a new individual will be living with you on your property, so ensure you’re protecting your investment and yourself by thoroughly screening tenants before signing a rental agreement.

With convenient online tenant screening from SmartMove, you gain access to all the information you need to make a more confident leasing decision. SmartMove background reports include credit checks, eviction history, criminal records, an Income Insights report, and ResidentScore within just a few minutes. And, like the majority of the millions of landlords who use SmartMove, you can choose to have your prospective renter pay the fee.

2016 SmartMove survey*

Know your applicant.

Additional Disclosure:

The information posted to this blog was accurate at the time it was initially published. We do not continue to guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion Rental Screening Services, Inc. blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.