Summary:

As a landlord, it’s essential you have goals in mind when searching for the perfect tenants for your property. However, how can you tell if your tenant screening criteria are too strict Having an overly restrictive tenant criteria can prevent you from filling vacancies or even overlook acceptable candidates. Some aspects of your screening criteria that could be too strict include having a rigid minimum credit score requirement, stringent rent-to-income ratio range, inflexible criminal record policy, and a no pets policy.

Read through this article to evaluate your tenant screening criteria to ensure that you fill vacancies quickly with great tenants.

Disclosure: This content, except as otherwise indicated or stated on this site, is the property of TransUnion Rental Screening Solutions, Inc. This content is for educational purposes and for convenience only. Trademarks used are the property of their respective owners, and no endorsement or affiliation is implied. The information presented in this content is “as is” without warranties of any kind, and specifically is not represented to be complete and does not constitute legal advice, and is subject to change without notice. You are encouraged to check these terms from time to time for changes, and by accessing this site you agree to these terms and all terms listed. Laws and regulations may vary by state and locality. Consult your own counsel if you have legal questions related to your rental property practices and processes.

You’re more than a landlord. You’re an expert juggler that handles a million major decisions, all while walking on a financial tight-rope stretched between two opposing sides. Sure, you might not have a shiny leotard or pet tiger, but you, too, must keep everything in perfect balance if you want to profit.

Finding that equilibrium means constantly navigating between choices, whether it is figuring out exactly what rent to charge, the ideal duration of your rental agreement, or, above all, who to accept as a tenant.

Your intent is to find that perfect tenant who will occupy your rental unit for years. But, selecting the wrong tenant can lead to plenty of problems. Damage to your rental property, violation of lease terms, non-payment of rent – all can take a big chunk out of an independent landlord’s bottom line.

It’s understandable that you might be weary about your next tenant. You’re not alone. About 84% of landlords consider “payment problems” their primary concern when it comes to finding a new tenant. And, it makes sense; as nonpayment of rent could leads to a variety of serious problems, including falling behind on your own financial obligations and, in worst-case scenario, having to go through a costly eviction process.

The cost of a having to evict someonecan be as much as $10,000 or more. In addition to the financial hit, evictions take at least three to four weeks to finalize and the process can be incredibly demanding on your time and attention—resources that are typically scarce for independent landlords.

With all these potential problems and justified worries, it makes perfect sense that landlords want to set strict rental screening criteria to have the best odds of finding a responsible tenant.

There may be a danger in being too restrictive.

Having very strict renter criteria could lead to an extended vacancy. You can unintentionally filter out otherwise great candidates. Considering vacancies can cost landlords up to $1,750 per month, it is worthwhile to understand the factors that go into selecting a great tenant, review your own criteria, and employ a comprehensive screening service that will give you the financial and behavioral insights you need to make a confident rental decision—regardless of how your applicant looks on paper.

If you’re seeking perfect balance, then a comprehensive tenant screening service like TransUnion Smart Move can give you invaluable insights that can help guide your tenant selection. Below we’ll look at some of the criteria landlords consider while choosing someone.

Consider the following to help you determine whether your screening policy is too restrictive or too relaxed:

- Minimum Credit Score

- Rent-to-Income Ratio

- Criminal Record

- Pet Policy

Minimum Credit Score

Many landlords include a tenant credit check within their tenant screening policy, and for good reason. Credit history can be a great indicator of whether or not your prospective tenant is likely to pay rent on time. A strong credit score may suggest financial responsibility, whereas a pattern of late payments and mounting debt indicated by a lower score might provide cause for concern.

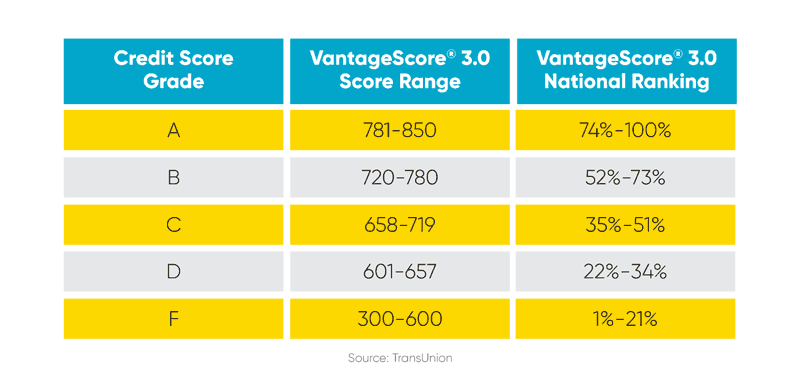

TransUnion has provided some guidance on the quality of certain VantageScore 3.0 ranges in the chart below.

VantageScore Credit Score Grades

The bands and grades are helpful. But understand this: a credit score is just a score and doesn’t reveal the whole credit profile that you can find contained within a full credit report. The problem with looking at only a credit score is that there is no definitive “bad” credit score for renting. Credit-worthiness depends on a number of factors, including the duration and performance of borrowing history.

Older rental applicants are more likely to have higher credit scores than much younger applicants. They’ve had time to establish positive payment performance, as reflected by many opened accounts. If they ever fell on hard times, then chances are that they’ve since been able to pay back their debts and raise their score to good standing. Gen Z tenants and Millennial tenants have newer credit profiles compared to those with a long history of borrowing. So blemishes that appear on their credit check could an exaggerated negative effect.

Rather than setting an absolute minimum credit score, landlords should consider establishing a range of acceptable scores that reflect the target demographic for their rental unit. To help avoid an overly restrictive screening policy, you might also allow for a cosigner if the applicant’s score is too weak to be held accountable on its own. This strategy may be effective when renting to college students since they probably haven’t had enough time to demonstrate their credit-worthiness.

It’s also important to look beyond an applicant’s credit score and get a fuller picture of an applicant’s financial situation. In fact, 4 out of 5 landlords surveyed by SmartMove say that reviewing a full credit report is important to understanding the applicant’s true credit history.

Rental statistics show that the average TransUnion ResidentScore® was 650 in 2017. Compared to other annual scores, this is a decline of 2%, suggesting that the renter population has become slightly less credit-worthy. You should keep this shift in mind while determining your rental criteria.

Before you order a full credit report from an agency, make sure that the provider offers a complete, in-depth look at your applicant’s financial history.

Protip: Also consider the type of credit score you’re checking. SmartMove provides landlords with a ResidentScore, which is a better predictor of tenant behavior than a generic credit score. ResidentScore was created by TransUnion, a trusted credit bureau, and was designed exclusively for independent landlords who need to make informed leasing decisions.

Bottom line: Enforcing a minimum credit score could mean missing out on a great tenant who hasn’t had the time to build credit or is still working on repairing poor credit history. Examine your tenant’s income and payment history to learn if they can afford to live in your rental property.

Rent-to-Income Ratio

The rent-to-income ratio is the golden rule for how much income a prospective tenant should make compared against the price of rent you charge. The industry standard suggests that your applicant’s gross monthly income should be at least three times the cost of rent to safely cover rental expenses, including the security deposit, and any move-in fees, while keeping up with the cost of living. However, this strict screening policy is also complicated by a variety of factors—especially location.

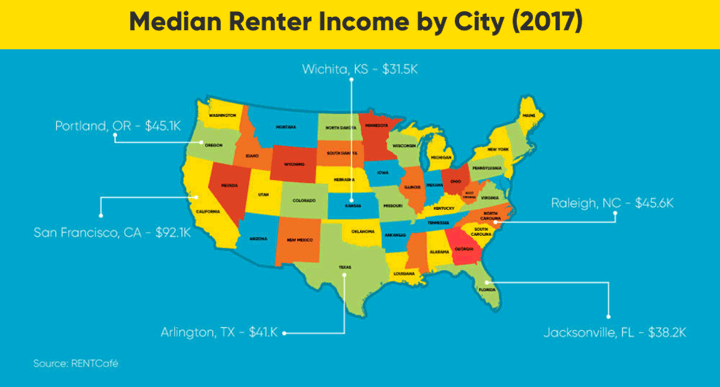

As seen in the map above, the location of your rental property has a significant impact on how much you should charge and the corresponding income verification you should expect from your tenants. For example, if you’re a landlord in Wichita, where the median renter income is $31,500, your verified income requirement will likely be lower than in San Francisco, where renters average a salary of $92,100. You should also take into consideration which utilities tenants are responsible for paying or what will be included in the rent.

Ultimately, your rental property should be priced at fair market value and you should request proof of income that supports the applicant’s ability to afford rent on top of their outstanding financial obligations. Using a SmartMove tool like Income Insights can instantly notify you as to which applicants need additional income verification and which applicants you could choose to approve immediately.

Bottom line: Demanding a certain rent-to-income ratio may significantly narrow your pool of applicants, especially in geographical areas where fair market value is significantly higher than the national average. It is best to be thorough in your screening process and view your applicants contextually rather than judge from a credit score alone.

Criminal Record

If you have strict renter criteria regarding criminal records, you may need to reconsider, as landlords must tread carefully when denying an applicant based on previous criminal history.

The use of a blanket policy to deny prospective tenants with a criminal record might lead to discrimination against a legally protected class. It could also be possible that previous criminal charges or convictions could have little impact or connection to an applicant’s potential behavior as a renter, such as non-violent crimes, traffic violations, or convictions that occurred long ago.

When setting renter criteria about criminal past, landlords should consider severity, nature, and timing of criminal convictions before denying an applicant. In addition to asking about criminal charges or convictions on a rental application, you should also consider running a tenant background check using a comprehensive service like SmartMove, which will help you see if there is anything your renter is not telling you.

Bottom line: Not all criminal convictions should immediately disqualify a rental applicant. Consider the severity of the crime and the legal parameters surrounding this renter criteria.

No Pets

Landlords are often faced with weighing their pet policy options. Although a “No Pet” policy sounds like a good idea to prevent pet damage, such a policy could be too restrictive and severely limit your options during tenant screening.

About 60% of pet-owners struggle to find rental properties that will accept their four-legged friend. That’s because many landlords fear the property damage that an animal might incur beyond normal rental wear and tear, or they are unable to receive coverage from their insurance provider unless there is an addendum within the lease that prohibits pets from residing on the property. It’s worth noting that allowing tenants with pets can significantly increase your pool of applicants, especially if the applicant pool is thin.

When considering your pet policy, also consider if it makes sense for the property. Is there a backyard Is it a single-unit or multi-family residence To further mitigate the risk of paying out-of-pocket for damages incurred by Fluffy or Fido (or even Bubbles), you could charge a higher security deposit, pet fee, or increased rent to offset potential costs.

One of the best ways to ensure your tenants won’t take advantage of a flexible pet policy is to verify their rental history and see how they’ve acted in the past. By asking the right questions during a landlord reference check, you can glean insight into whether a pet was well-behaved, if the property was well kept, and if the neighbors were respected.

SmartMove simplifies this process by showing landlords their risks of having to evict through the online tenant screening process. These insights can alert you to a prospective tenant who has some blemishes on their rental history—whether that may be from a noisy pet, a violation of lease terms, or rent non-payment—signaling you to move on to the next applicant.

Bottom line: Banning pets from your rental property may mean missing out on high quality rental applicants. Take another look at your leasing terms and determine if you’re willing to reconsider allowing pets with a security deposit.

Use Well-Balanced Screening Criteria With Comprehensive Tenant Screening

Having your tenant screening criteria defined and implemented is good practice. But, using overly stringent requirements can cause you to lose out on otherwise great applicants. If you’re finding it difficult to secure a tenant that meets all of your criteria, take another look at your screening requirements and ask yourself if they are helping your business or harming it.

You can set applicant standards as you see fit, but even the strictest standards won’t tell the whole story. To really protect yourself and your property, you need a well-balanced screening policy that includes a comprehensive background check.

Spotting any tenant red flags ahead of time will help to prevent serious financial losses down the road. And, SmartMove can help landlords make more informed decisions. And, trust can be achieved quickly because you get a fuller picture of your applicant, helping you make a more informed leasing decision, on-the-spot. With unique screening tools, SmartMove helps landlords make confident leasing decisions.

- ResidentScore®, our proprietary credit score for the rental industry, is proven to reduce eviction risk better than a generic credit score.

- Income Insights, a report that helps to analyze applicant self-reported income, helps to reduce renter payment risk. With unique insights and critical information fast, landlords can fill their rental unit quickly and with more confidence.

- Plus, our quick process enables renters to be screened right away and potentially move into their dream rental unit same-day.

With access to tools that deliver critical information fast and a simple combined with quick process for renters to share their personal information in a safe way, SmartMove makes it possible to achieve trust between renter and landlord nearly instantly.

Being a landlord means there are a lot of decisions to make, but it doesn’t have to be a circus; get started today and let online tenant screening from SmartMove help with the balancing act.

Know your applicant.

Additional Disclosure:

For complete details of any product mentioned in this article, visit www.transunion.com. This site is governed by the TransUnion Rental Screening Privacy Policy Privacy Notice located at TransUnion Rental Screening Solutions, Inc. Privacy Notice | TransUnion.